BCA investments and Aada Finance, the first lending protocol powered by Cardano, are partners!

BCA investments and Aada Finance, the first lending protocol powered by Cardano, are partners!

Aada enables users to lend and borrow cryptos on their platform. This decentralized protocol is an important addition to the DeFi ecosystem. In this article, you can read about our partnership with Aada Finance, as well as more information about this Cardano lending platform.

BCAi x Aada

As the first of its kind DeFi lending protocol on Cardano, Aada Finance brings important functions to the DeFi ecosystem. By building lending and borrowing on a decentralized protocol, Aada allows everyone to lend and borrow cryptocurrencies in a trustless manner.

We are happy to be working together with the first DeFi lending protocol on Cardano! Read on to find out more about this platform.

How does Aada work?

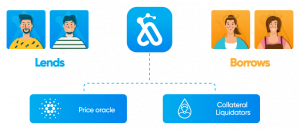

This decentralized non-custodial crypto assets lending platform works with smart contracts, which allow people to do the following:

- Deposit assets and collect interests

- Borrow assets and perform financial actions

The above-mentioned strategy increases the DeFi possibilities on Cardano. Also, the protocol’s Cardano ERC20 converter will bring big asset amounts into the (cheaper) Cardano blockchain. ERC20 tokens can be migrated to Cardano quickly, by transforming them into a special native token on Cardano (with the same value and works as the ERC20 token).

Pooled Lending Protocol

Aada Finance uses a pooled lending mechanism to make lending easier and more available. The mechanism works with very low transaction fees. Apart from lending and borrowing assets, users can also borrow undercollateralized loans (Flash Loan) and swap deposited assets (made possible by Flash loans, which allow users to instantly swap assets without withdrawing or re-depositing).

Aada academy

The platform has its own community, called Aada academy. The goal is to build a strong and vibrant DeFi community, and unite this community under one roof. Aada’s Smart Contract developers will help with the growth of community projects.

The platform has its own community, called Aada academy. The goal is to build a strong and vibrant DeFi community, and unite this community under one roof. Aada’s Smart Contract developers will help with the growth of community projects.

AADA token

Aada’s token, AADA, will be used for certain utilities. By holding AADA, token holders will receive certain compensation (generated by Aada’s platform), as well as participate in the governance of the platform.This decentralized money market protocol brings important functions to DeFi. By enabling users to lend and borrow cryptocurrencies in a trustless manner, the platform has significant utilities. As one of the first lending protocols built on top of Cardano smart contracts, Aada Finance is an important addition to the (Cardano) DeFi ecosystem.

BCAi is happy to have partnered up with Aada Finance! Currently, people can join the ISPO (Initial Stake Pool Offering). The ISPO mechanism allows users to delegate their ADA to the Aada staking pool in order to receive $AADA. Anyone can join the ISPO at any given time, before it ends. The end date is February 19, 2022.